I get my best ideas when I’m talking them out, so you’re invite to participate in an open webinar series to explore seven main topics in this research project.

To register and get reminders, go to the Eventbrite page here:

https://www.eventbrite.ca/e/strategyfest-webinars-on-scaling-to-win-tues-sept-19-to-oct-31-2017-tickets-37944930308

The videos of each session will be posted here on scaleup.davender.com about 24 hours after each session.

DESCRIPTION

What are the major stages of scaling a high-performance venture from market entry to market leadership, and what are the success criteria for each stage?

Explore the success criteria of scaling your venture, whether you are a startup entering the market for the first time, or an established business launching a new product or into a new market.

Presented by: Davender Gupta, Co-Founder and Venture Strategist, The Scaleup Project

Connection instructions:

Join from PC, Mac, Linux, iOS or Android: https://zoom.us/j/738326695

Or iPhone one-tap :

US: +14086380968,,738326695# or +16468769923,,738326695#

Or Telephone:

Dial(for higher quality, dial a number based on your current location):

US: +1 408 638 0968 or +1 646 876 9923

Meeting ID: 738 326 695

AGENDA

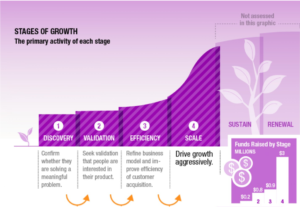

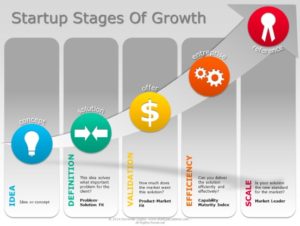

Prior to 2011, startup founders had to discover what worked and what didn’t, mostly through trial and error. Then the research published by Max Marmer (Startup Genome), Eric Ries (Lean Startup), Steve Blank (Customer Discovery) and others provided a more evidence-based and systematic process to guide entrepreneurs from idea generation through validation and initial launch. These frameworks greatly increased the quality and success rate of entrepreneurs, while reducing risk and cost.

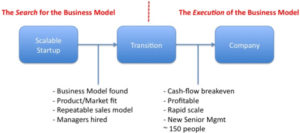

However, most of these frameworks end at market entry, treating the rest of the process as a generic “scaleup” phase. In reality, scaleup is now the riskiest and most capital-intensive part of launching.

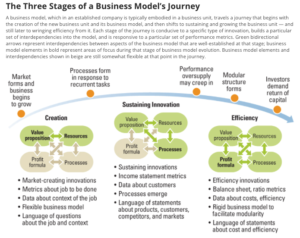

My basic hypothesis is that there is a “scaleup framework” with distinct phases, priorities and success criteria, which can be used by entrepreneurs, investors and ecosystem managers to reduce the risk of scaling up while improving the success rate.

This series of seven webinars will explore various parts of the model. You are encouraged to provide your comments and feedback.

The planned agenda is (all sessions start at 1PM Montreal time for approximately 30-45 minutes)

#1 – 19 Sept: What is “Scaling”? Defining “scaleup” and the Scaleup Lifecycle Model

#2 – 26 Sept: Scaling your Market: Identifying your beachhead market, finding early adopters and reference clients, blue or red ocean markets

#3 – 03 Oct: Scaling your Business Model: Your business model will evolve as you enter and expand in your beachhead market. Continuous validation, when to pivot or stay the course, your initial place in the value chain

#4 – 10 Oct: Scaling your Systems: How you systematize your operations, what systems to prioritize and when, developing your execution maturity

#5 – 17 Oct: Scaling your Leadership and Culture: Expanding your team, adding marketing, sales and customer support, evolving your leadership team, mission, values, vision and permission

#6 – 26 Oct: Scaling your Finances: Where do put your focus – market share or revenues; scaleable capital, financial systems and metrics. When to double down or pull the plug

#7 – 31 Oct: Scaling for Resilience and Anti-Fragility: Making choices in difficult and unpredictable times

Register to get an e-mail with the connection instructions, links to the recordings and other information.

For info: Davender Gupta (organizer) davender@davender.com 514-448-1894